Bridging the Climate Reinsurance Gap: Our Investment in Demex

As climate change drives insurers out of secondary‑peril markets, Demex uses granular weather data to price stop‑loss reinsurance, already binding $65 M in coverage and led by a team with decades in weather risk.

Sep 12, 2024

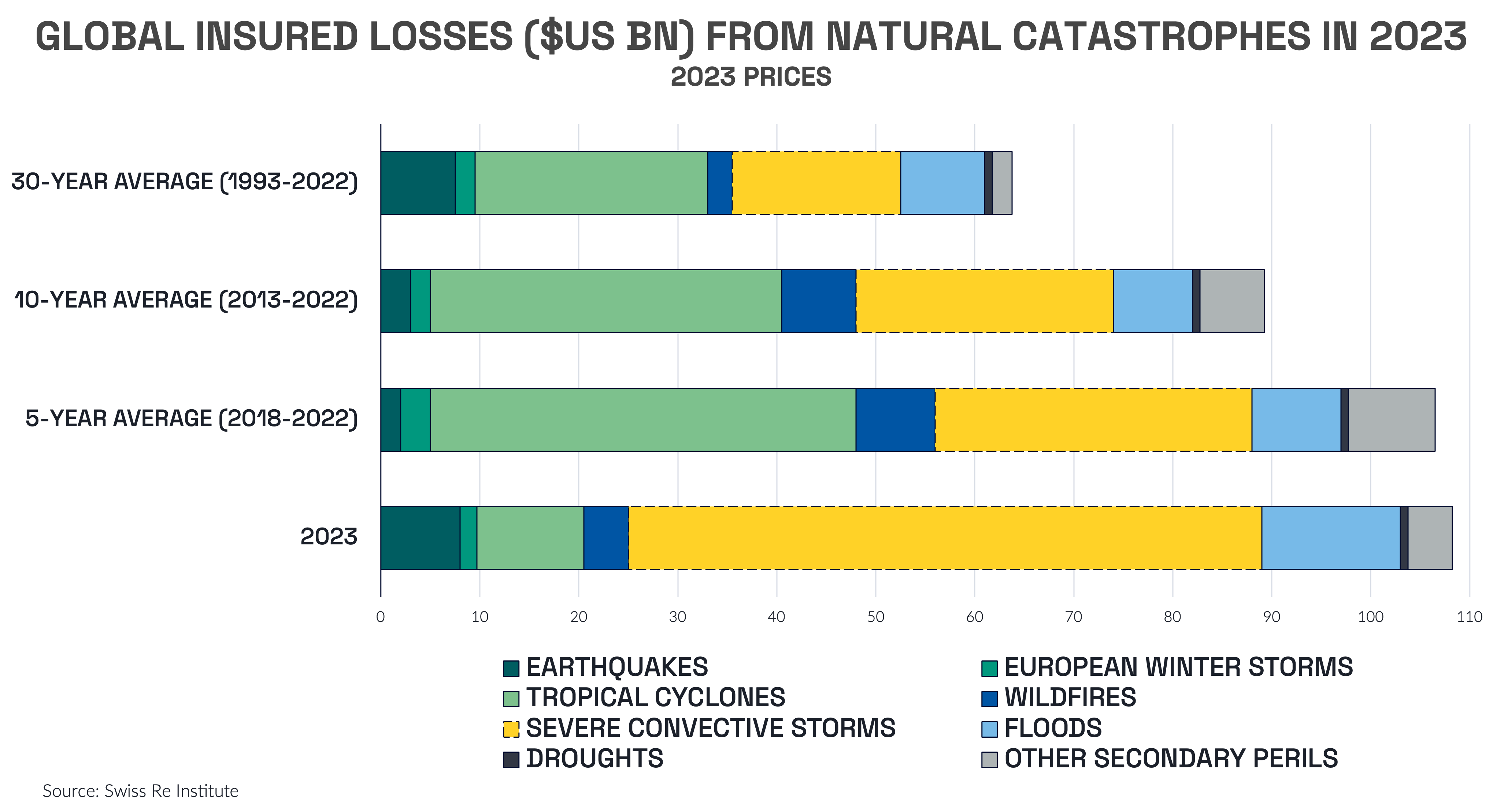

The nature of storms has fundamentally evolved. Climate change (among other factors) has led to an increase in the frequency and severity of not only headline-grabbing catastrophic weather events like hurricanes and wildfires but also secondary perils (e.g. tornadoes, thunderstorms, hail and wind), which are now responsible for the majority of insured losses in the US.

Historically, insurers have turned to reinsurers as a way to offload some of the weather-related risk burden associated with underwriting and issuing a P&C policy. While insurers and reinsurers have utilized complex catastrophic risk models to maintain a functioning risk transfer model for lower frequency, high severity weather events like earthquakes and hurricanes (i.e., primary perils), the reinsurance market for more frequent secondary perils has deteriorated in recent years.

Secondary perils represent a shifting (and growing) risk profile which traditional catastrophe models, used historically by reinsurers to price and sell reinsurance to insurers for primary perils, are ill-equipped to model. As a result, reinsurers, once responsible for owning a portion of the risk stack, have exited the market in droves and left a sizable protection gap for insurers to fill with their own reserves.

Without a viable secondary peril reinsurance market, insurers have been forced to increase pricing, scale back secondary peril coverage, and in some cases exit markets entirely in order to protect their own balance sheets. New product innovations are needed to accurately model and price these risks and enable reinsurers to re-enter the market.

Enter Demex.

Demex offers a unique stop-loss risk transfer solution that prices secondary peril reinsurance risk and settles corresponding claims.

Demex leverages robust weather datasets and advanced data analytics to identify the underlying variables that correlate strongly to higher frequency, lower magnitude secondary perils. The company’s models are then custom calibrated using historical data at each insured location within an insurer’s portfolio to quantify and price secondary peril risk within their book.

In partnership with leading reinsurance brokers, Demex is able to help insurers and reinsurers once again structure and manage risk transfer agreements for secondary perils as the frequency, nature and costs of these risks continue to grow. In doing so, Demex relieves mounting pressure on carrier’s balance sheets, enables reinsurers to re-enter a multi-billion dollar market, and puts downward pressure on consumer’s rising P&C insurance premiums.

Demex’s model is resonating. The company bound $65 million of reinsurance in its first selling season, working with several of the industry’s leading reinsurers and reinsurance brokers.

When we first met Bill and the Demex team, we immediately recognized the founder-market fit. Demex’s management has a level of domain expertise rarely seen in early-stage startups and we believe it is a true differentiator in their positioning. Much of the leadership team has had extensive exposure to reinsurance, particularly at Citadel and MunichRe. We believe that the team that has been assembled at Demex has the ability to execute effectively in this highly specific and technical space.

We are excited to announce MetaProp’s participation in Demex’s Series A financing. As climate change continues to influence global weather patterns, the demand for innovative reinsurance solutions is projected to grow. Demex is well-positioned to play a pivotal role in this evolving market, contributing to the development of a more resilient insurance industry capable of better withstanding climate-related challenges.

If you are a P&C insurer, reinsurer, or broker looking for a new way to play the space, get in touch with the Demex team!

Further reading: “The Demex Group Raises $10.25 Million to Address Growing Demand for its Breakthrough Weather- and Climate-related Reinsurance Solution” via Demex.

Tagged: venture capital, zak schwarzman